Continuing on our theme of experimentation, we will now shift our focus to a newly popular idea: Guaranteed Income (GI). Ten years ago this was considered unthinkable; but after a global pandemic, more people are open to the idea than ever. Popularized by Andrew Yang, GI has gained influence within some powerful institutions. In this post, we do not take an explicit stance on the GI debate, but instead, examine why it may or may not be a good tool for policymakers in the future.

What is Guaranteed Income?

Guaranteed Income is a direct cash transfer to an individual, but this can come in two forms: universal or conditional. Conditional income creates certain requirements for receiving this money. For example, one may only receive conditional income if they make below 40% of the national average income. A universal income, on the other hand, is given to everybody, hence universal.

What are the positive impacts of GI?

During the Covid-19 pandemic, the United States Senate passed the American Rescue Plan Act which authorized over $900 billion in direct cash transfers. Each individual over 18 received their $1400 check in order to alleviate the economic stress induced by the resulting lockdowns. When a majority of people couldn’t work or pay their bills, the GI they received helped get them through these difficult times.

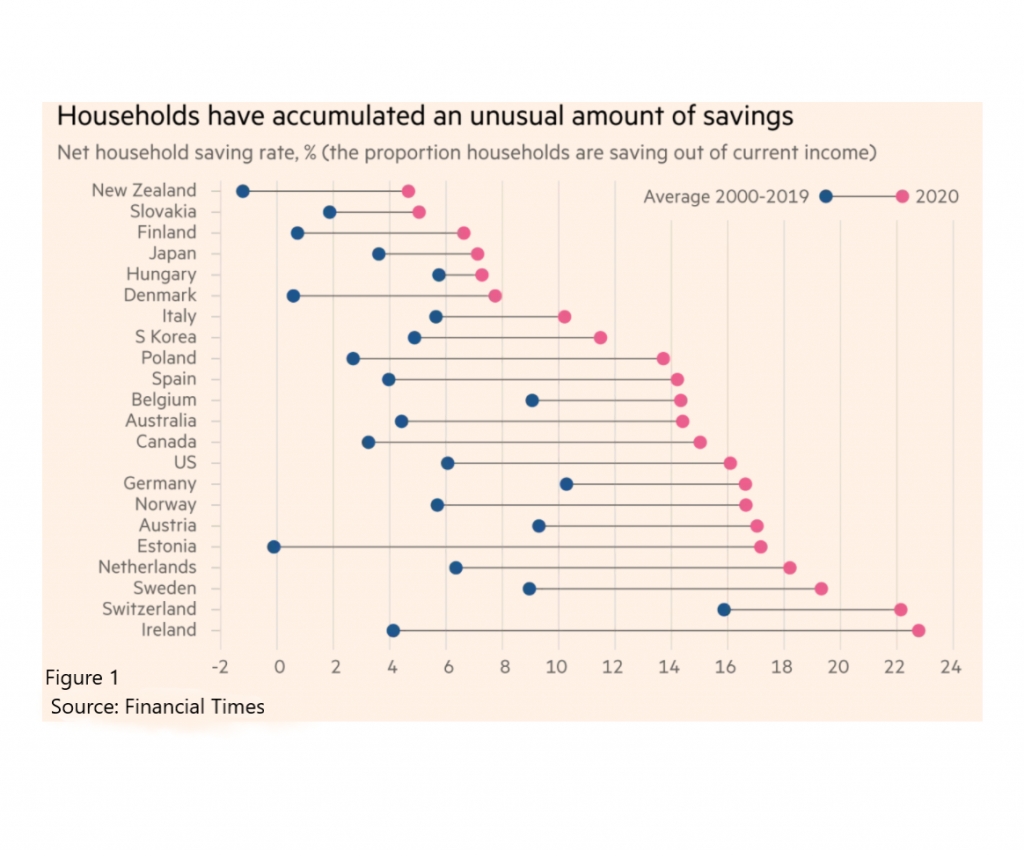

But Guaranteed Income can affect more than just stress. Pre-pandemic, 40% of Americans say they couldn’t afford a $400 emergency, according to the Federal Reserve. However, after the American Rescue plan Americans saved an average 16% of their disposable income (Figure 1, Valentina 2021). When it comes to savings, GI can be quite impactful.

Another attractive feature of Guaranteed Income is its efficiency. Policymakers often struggle to understand what solutions best help their communities. From food stamps to affordable childcare, it can be hard to calculate how much should be spent where. Instead of guessing, and in some cases incorrectly, GI empowers individuals to spend how they see fit. If childcare is their most pressing issue it can be spent on daycare. If a household has trouble providing food, they have more money for groceries. A guaranteed income is a more refined and efficient social safety net.

What are the negative impacts of GI?

But like any other policy, it also has its downsides. Many opponents of Guaranteed Income believe it can negatively affect employment. If everyone will receive a check at the end of the month, why work at all? If everyone can meet their basic needs, what motivates them to improve their lives? During times of transition, this would stop people from adapting and allow them to happily languish, so the argument goes.

There is also an increased burden on already-sky-high debt. Andrew Yang’s policy of $1000 per month for each citizen would cost the US around $2.8 trillion a year (Pomerleau 2020). Heavily indebted nations may not be able to sustain these burdens and risk cutting other social safety net programs. GI could be most impactful in the very countries where it can’t operate.

And finally, there is the inflation and wage argument: If everyone receives a monthly check this could cause prices to rise and wages to stagnate. When employers know their employees can pay their expenses then there won’t be as much pressure to offer raises. Why would your boss offer you more money when he knows you can afford your current lifestyle? But it’s not just your boss who knows you receive Guaranteed Income, it’s the stores you shop at and the restaurants where you eat. If firms know everyone has more disposable income then they can get away with price increases. Who would notice an extra dollar or two on their meal if they make an extra $500 a month?

The debate on Guaranteed Income has just begun. New programs are popping up all over the world and will require watchful supervision. These experiments will offer some exciting insights into whether or not this is an exciting new way to fight poverty or just another facet of our social safety net. We hope this has made you think about the effects of Guaranteed Income, as it may become the go-to tool of the future. Only time will tell. Check back next week for some exciting new content as we continue our discussion of Guaranteed Income!

Works Cited

Federal Reserve, Board of Governors, et al. Report on the Economic Well-Being of U.S. Households in 2017, Community Development Research Section, 2018.

Pomerleau, Kyle. “Does Andrew Yang’s ‘Freedom Dividend’ PROPOSAL Add up?” Tax Foundation, 2 Jan. 2020, taxfoundation.org/andrew-yang-value-added-tax-universal-basic-income/.

Romei, Valentina. “Global Savers’ $5.4tn Stockpile Offers Hope for Post-Covid Spending.” The Financial Times, 18 Apr. 2021.