While it is always important to think outside the box and innovate, it is always useful to reflect on past successes. Since we focused on new ideas the past few weeks, we here at the Give Me 5 Campaign want to look at what we already know works. This week we are looking at successful ways of achieving No Poverty.

A Plumber You Say?

Nobel laureate Esther Duflo’s paper, The Economist as a Plumber, offers a new perspective for policy-makers. Often we try our best to invent new policies that will solve our hardest problems. When economists do this they are thinking like engineers creating new machinery, except this machinery comes in the form of institution-building and policy craft. Instead, policy-makers should think more like plumbers.

Plumbers don’t devise or create new mechanisms, they simply tweak what isn’t functioning properly. Leaders do not always have to reinvent the wheel or come up with complex solutions. More often than not policy requires small but continuous adjustments to what already exists.

Policy-Plumbers in Action

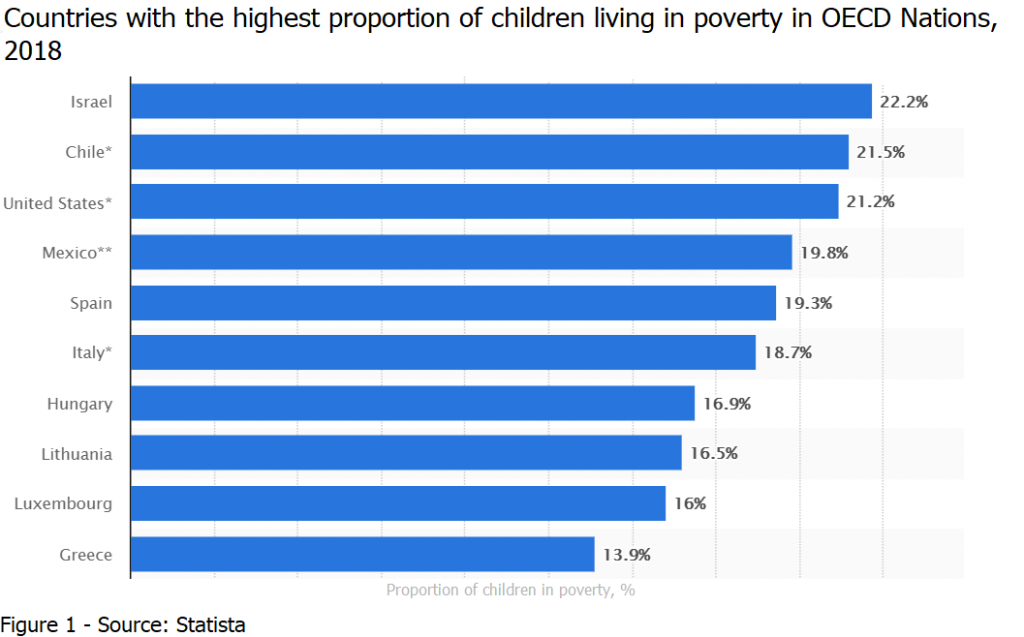

The existence of childhood poverty has haunted the United States for some time now. In 2018 the US had the third highest child poverty rate within the OECD (Figure 1, M. Szmigiera and 12 2018). Researchers were expecting a 20% childhood poverty rate in July of 2021. Instead, they were pleasantly surprised it had dropped to 16% (The Economist 2021). What changed?

In March, the United States Senate passed a $1.9 trillion relief package. Along with $1,400 checks came the expansion of the Child Tax Credit (CTC). The Child Tax Credit sends families with children 6-17 years old $250 per child each month. For children 6 and below, families will receive $300 a month. These regular payments are projected to majorly impact childhood poverty within the US.

In June childhood poverty declined from 15.8% to 11.9%. This decrease amounts to a little more than three million people, a remarkable accomplishment. Hunger amongst children declined as well (Figure 2). Homes with children without enough food in the past week fell from 13.7% to 9.5%. This small change had a swift but monumental impact. But CTC has existed since 1997, yet it was never quite this effective. So how did this policy go from powerless to potent?

The Taxpayer Relief Act, passed in 1997, gave families an annual $500 tax credit for each child (Tax Foundation 2021). The amount gradually increased over time and had marginal effects. What economists see as the biggest change was the frequency of these credits. Before 2021 checks were sent annually. This meant parents would receive a lump sum and would need to budget it throughout the year. With monthly checks, families were better able to allocate their money as they saw fit. Though the CTC has proven effective thus far it may not be around for too long.

A recent article from The Economist points out the strengths and the weaknesses of this adjustment to CTC. On the one hand, costs and barriers to access are lowered via automatically deposited checks. But, these new changes only last for a year, meaning they will revert to their pre-pandemic frequency and amount unless action is taken. We stress this point not because we think this policy should stay, but rather we believe the perspective of the plumber has shown to be successful with the Child Tax Credit and could improve policy in the future.

Works Cited:

Iacurci, Greg. “Child Tax Credit Lifted 3 Million Kids from Poverty in July.” CNBC, CNBC, 25 Aug. 2021, www.cnbc.com/2021/08/25/child-tax-credit-lifted-3-million-kids-from-poverty-in-july.html.

Published by M. Szmigiera, and Mar 12. “Child Poverty in OECD Countries.” Statista, 12 Mar. 2021, www.statista.com/statistics/264424/child-poverty-in-oecd-countries/.

“What Is the Child Tax Credit?” Tax Foundation, Tax Foundation, 2021, taxfoundation.org/tax-basics/child-tax-credit/.

“When Policy Works.” The Economist, 18 Sept. 2021, www.economist.com/united-states/america-is-substantially-reducing-poverty-among-children/21804765.